Payment on limber is straightforward and easy to understand. Here’s how it works.

How do I get paid?

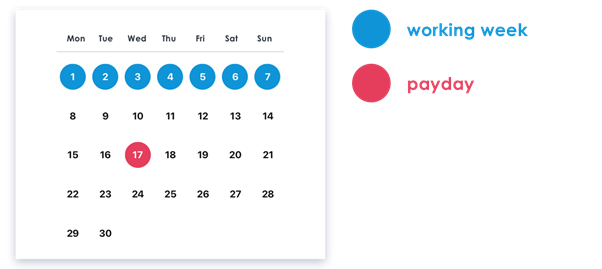

You will receive pay weekly. Anything you work in a given working week (Monday to Sunday) will be paid to you on the Wednesday in the second week following the week you worked. Check out the diagram below. 👇

Payroll is operated on a PAYE basis, meaning that tax and national insurance contributions are calculated and deducted from your pay automatically.

How can I ensure I’m paid correctly?

Once you’ve finished working a shift, you’ll be asked to submit your timesheet. It is your responsibility to check the times on your timesheet and, if necessary, change the times to reflect the actual number of hours you worked.

After submitting your timesheet, it will then go to the hirer to be confirmed. If a hirer doesn’t manage to complete your timesheet, it will close out automatically to ensure you’re paid on time.

How do you change my payment details?

Tap on the ‘settings’ cog in the top left section of your profile. To receive your pay on time, you must do this before you complete your first shift. If we do not have the correct payment details when we run payroll (on the Thursday before payday), then your pay may be delayed or sent to the wrong account.

Why have I been paid less than I was expecting?

We get this question a lot, and 99% of the time, the deduction is tax. You can find out if you’ve been taxed by checking out your payslip.

To find this, head to paycircle, and login. If you’re yet to create an account, get in touch and we’ll invite you to register. You can view and download your payslip from the ‘documents’ section. We’d recommend clicking around and familiarizing yourself with paycircle, as this is where you’ll be able to keep track of all your earnings.

Occasionally, when your employment status changes, you can be taxed incorrectly. If you think this has happened to you, you need to contact HMRC and ask them to update your tax code. Once this has been done, a rebate will be issued the next time you’re paid, so you won’t be out of pocket.

Are breaks paid?

We like it when hirers pay breaks, but they’re well within their rights not to. A hirer should specify before you start your shifts whether or not breaks are paid. If you take an unpaid break during your shift, the hirer can add this to each timesheet and it will be reflected in your payslip.

How do I claim holiday pay?

You will receive holiday pay for each hour you work (as is marked in each shift). This means there is no process to claim it. We do this because it’s fair to everyone and it means no one misses out on it (most people don’t even know they’re entitled to it).

Do I get sick pay?

No employment relationship exists between shifts which means in most cases, most of the time, you’re unlikely to be entitled to sick pay.

You may be entitled to SSP if your average earnings are high enough (£120pw ) and you will typically need 3 months of shifts to qualify. If you believe you are eligible, you’ll need to provide a ‘fit note’. We’d advise reading the guidance thoroughly before requesting this.

Do I have to contribute to a pension & how do I opt out?

Once you’ve been working on the platform for 3 months, you’ll be automatically enrolled in a pension. The auto enrolment rules exist to encourage workers to save for retirement. If you are a taxpayer, you’ll benefit from tax relief when you make contributions to your pension. limber will also make contributions.

If you are assessed as eligible and enrolled in our workplace pension scheme, you can choose to opt out within one month of enrolment. If you opt out, you’ll get a refund of any contributions you’ve made, but you won’t benefit from any contributions your employer has made.

Outside of the one month opt out period, you can cease membership at any time.